Comprehensive insurance can be very beneficial, but what does it entail? Trueway Insurance in Palm Springs can clarify. When you are selecting auto insurance quotes, it is important to be informed about what you are signing up for. Here are some things that comprehensive insurance may cover.

What Does Comprehensive Insurance Include?

Bodily injury & property damage liability: These are two insurance coverages that are typically required in every state and may even be sold together as a bundle by some insurance companies. These policies cover damages in bodily injury as well as damage to property that other people own in situations where the person who is insured could be found responsible for the damage. In those instances, the insurance company can compensate the other party for whatever damage occurred up to the limit of liability.

Personal injury protection: PIP is a type of insurance that is offered in certain states that have a “no fault” system. This means that, regardless of who was at fault at the time of the accident, the insurance company pays out to assist you. Typically, this type of insurance covers things like medical expenses, funerary expenses, loss of income, cost of necessary household services, and other costs.

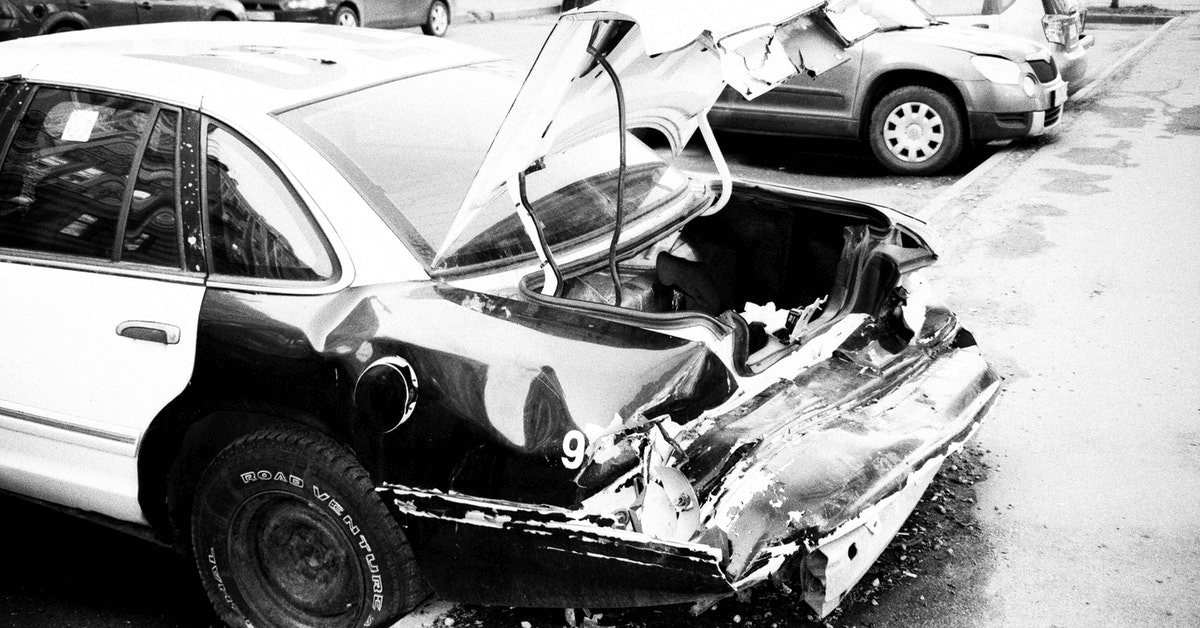

Physical damage coverage: Under the umbrella of physical damage are two different types of coverage. These are collision and comprehensive coverage. Collision coverage comes into play when there is damage to the vehicle that is covered after it has come into a collision with another vehicle or an inanimate object. Comprehensive, on the other hand, covers loss due to fire, theft, weather, animals, and other related incidents. With this type of coverage, you will typically be given a deductible to meet before the insurance company can begin to pay out.

Medical expense coverage: This exists in most states and it is made to help you or another insurance person that is injured in an accident. This applies regardless of who is at fault in the accident. While the coverage can come in many forms, it usually consists of coverage that kicks in from the first dollar spent or coverage that only covers what medical insurance does not.

Uninsured Motorist Property Damage: UMPD is only available in some states but it applies to property damage that is caused to your vehicle by someone who does not have insurance themselves.

Uninsured or Underinsured Bodily Injury: This type of coverage is made for those accidents where the insured person is injured and the party responsible does not have insurance or does not have sufficient insurance to pay for the damages. This coverage varies from state to state and it may be required in your state.

Do I Need It?

The best way to determine if you require comprehensive insurance is to speak to your insurance company about what exactly it covers. Comprehensive insurance will vary from company to company and what may be covered by one may not be covered by another.

Need Auto Insurance Quotes? Contact Us

Trueway Insurance is located in Palm Springs. If you are interested in auto insurance quotes for affordable insurance, contact us today.