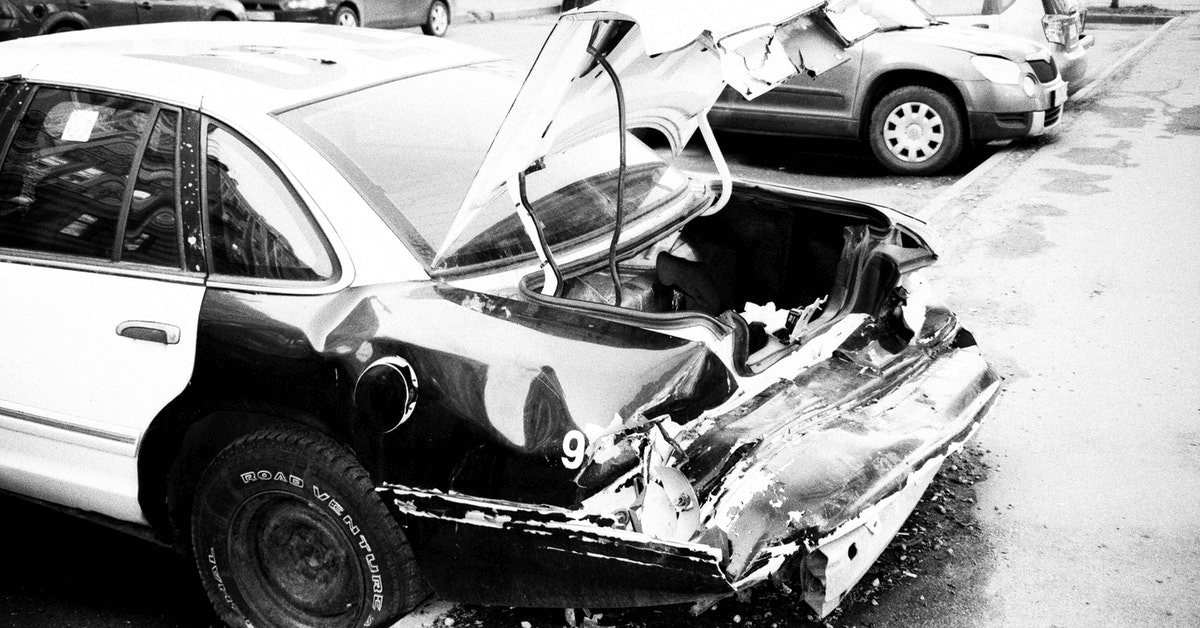

Have you ever sat in front of a computer with a list of car insurance quotes and had no idea what to do with them? Everyone seems to be able to make it to this point; you need new insurance, you go online, search up insurance companies, and get a pile of auto insurance quotes that are just numbers staring back at you. The next step is what everyone seems to struggle with, how to compare car insurance quote. Is looking at the price enough or are you doing yourself a disservice by not digging deeper? Contact TrueWay Insurance for more details.

Compare Car Insurance Quotes With Confidence

Typically when you are looking to switch insurance providers for your car, you will head to a site that provides auto insurance quotes from multiple companies and make your decision based on the price you see, but this isn’t the most effective way to choose a policy. The truth is, every policy includes its own specific details and services that wouldn’t be obvious through the price, which means you’re going to think you’re getting the best deal because you got the lowest price, but in reality, the services provided in your new policy may be lacking. Car insurance comparison websites could be a great tool if you know how to properly use them and you make sure that all of the quotes are for policies with identical details and services.

Tips For Identifying Top Insurance Coverage

- Get quotes from several companies: like anything that you are shopping for you don’t want to go with the first insurance policy you see. Getting auto insurance quotes for at least 4 or 5 companies at a time is ideal, as long as you are making sure all the details of the policies are the same. Remember you want to compare apples to apples. If there is one company that offers a significantly lower rate than all of these others this should be a red flag. The low balling company may be excluding certain types of coverage that could result in having inferior coverage.

- Make sure the companies have a good rep: Although people only like to talk about pricing when it comes to car insurance picking your new policy cannot be all about money. You need to consider the company providing the coverage. If the company you choose has the lowest premium, but they have a history of not paying claims or being difficult to get in contact with it’s not going to matter that you’re paying a low premium because that money is going to be wasted. Like any business insurance companies get graded through A.M. Best. Check the companies score and stay with companies that have a score of A++/A+ (Superior), A/A- (Excellent), B++/B+ (Good). A company with a rating below a B+ is having financial problems.

- Added benefits: Sure it’s important to make sure that the policies you’re comparing are identical, but it’s also important to look at any extra benefits that the companies offer. Some features may not matter to you, but others may be able to sway your purchasing decision so pay attention. For example, some companies may be more expensive, but they may offer towing/labor cost reimbursement, tire changes, gas delivery if you’re ever stranded and you run out! Also, pay attention to rental reimbursement features. This is an additional benefit that can help pay for a rental car if your car needs to be fixed. Some companies will offer up to $30 a day while others may only offer up to $20 and some may offer you nothing.

Contact Us

In order to compare auto insurance quotes effectively, you need to make sure you include all the best in the business. TrueWay is a leading insurance provider in Palm Springs and is here to help ensure you get the best coverage at the best price! Call or visit us today for more information.