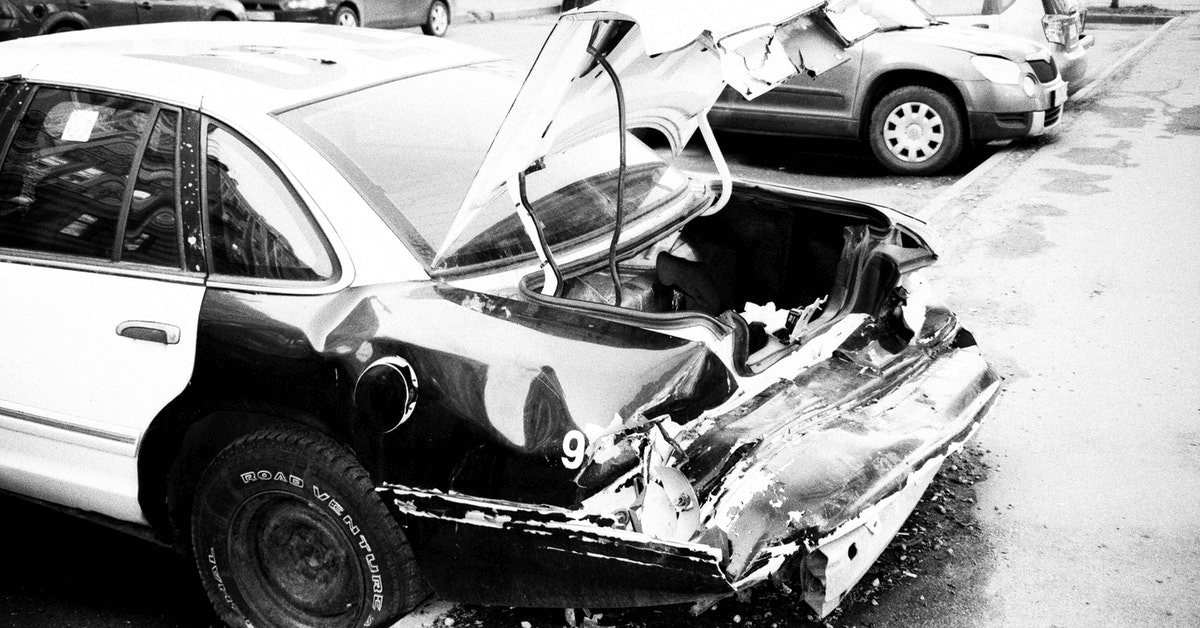

Your credit score is an important thing to protect and keep in mind, as it impacts a lot of things in everyday life. Your creditworthiness, or how likely you are to pay back a loan or credit-card debt, is how your credit score is determined. However, something that you may not be aware of is the fact that car insurers also go through your credit files in order to calculate something totally in their personal interest: they look at your credit score in order to predict that odds that you’ll file a claim. If they think that your credit isn’t up to their highest standard, car insurers will charge you more, even if you’ve never been in a car accident, according to data by Consumer Reports. Basically, your car insurance rates can be dependent upon your credit score. Trueway Insurance provides affordable, transparent auto insurance quotes in Palm Springs. Call us today for a consultation!

Your Premium Can Depend On Your Credit Score

Every insurer has a different algorithm when it comes to interpreting your credit score, picking through about 30 of almost 130 elements in a credit report, which means that every single insurer creates a proprietary score that’s very different from the FICO score you might be familiar with, so that it’s not possible to guess your insurance score from your FICO score. Your premium can be significantly increased. Merely good scores paid $68 to $526 per year, on average, versus similar drivers with the best scores, depending on what state they registered in. Your credit score, moreover, is able to have more of an impact on your premium price than any other factor. One moving violation for single drivers in Kansas, for example, would increase their premium by an average of $122 per year. Even if you have a flawless driving record, a score considere just “good” would boost your premium by $233. A poor credit score then adds $1,301 to their premium, on average.

Your Credit Score Can Impact Your Car Insurance Rates

Consumers are often kept in the dark when it comes to how insurance companies cook up their scores, as insurance companies are under no obligation to inform you. Thus, as a consumer, you often don’t have a clue whether you’re targeted for a price increase or if you’re considered a prime client. Credit scores came into play for auto insurance quotes in the mid 1990s. Working with the comapny that created the FICO score, car insurers began to test the theory that the scores might help to predict claim losses, on a hush-hush basis. Almost every insurer was using credit scores to set their premiums by 2006, yet two-thirds of consumers surveyed by the Government Accountability Office around that time period had no clue that their credit score came into play when it came to their insurance premiums. Even today, it’s not a widely known fact, and insurers don’t tend to advertise it- they don’t ahve to. A sudden drop in your score could cause them to cancel your policy or raise your rates, and in that case you’d receive an “adverse action notice,” which contains only the most cryptic information that has very limited use.

Contact Us Today

Your credit score can have a profound impact on your car insurance rates. For transparent, affordable auto insurance qutoes in the Palm Springs area, call Trueway Insurance today!