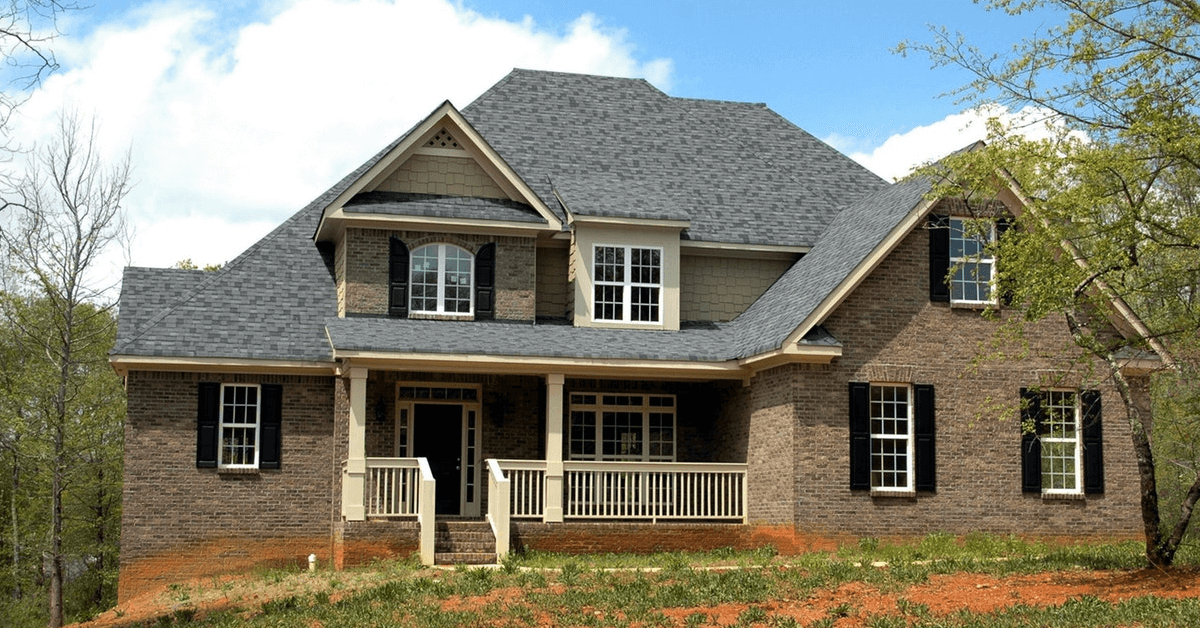

Home insurance is necessary for homeowners everywhere. When it comes to home insurance policy shopping, there are just a few things to keep in mind. As purchasing a home is one of the largest financial decisions you will have to make, it’s good to be informed when looking at home insurance quotes to protect your investment. Trueway Insurance is a top insurance provider in Palm Springs offering comprehensive and affordable insurance policies for any budget. We pride ourselves on our customer service and offer some of the best insurance prices in South Florida. Call us today for a free initial consultation!

What To Look For When Looking at Home Insurance Policies

When looking around online for home insurance, you may think that price is the only factor and go for the cheapest option, or perhaps not be thorough in your examination of the policy itself as well as the evaluation of your current situation. There are just a few thing things to consider when shopping for home insurance, as it is always good to be informed in order to make the best decision for your specific situation. Firstly, you should consider the location of your home when determining how much you should pay for home insurance. If you are in the market for purchasing a house, you should keep in mind that where your house is located can have an impact on how much you pay for home insurance. For example, if the house is located in the same area as volunteer firefighters, or the closest fire station is over 5 miles away, rates may be significantly higher. Your insurance premiums may also be higher if the house is in a geographical location that is more prone to natural disasters such as hurricanes or wildfires. There are also other regional factors that can affect your insurance rates, such as the crime rate of the area as well as the general building costs in the area.

When shopping for home insurance, you should know the costs that are involved. When purchasing a policy, you will want to have the house insured for its replacement cost, not its market value. The amount a buyer pays for the home is the market value, while the replacement cost is what expenses are needed to repair or rebuild the entire home, including the costs that may be necessary to transport the materials to the site, as well as other factors such as inflation being taken into account. As you start to build your policy, you will need to set homeowners insurance deductibles. The deductible on your policy is how much you’d pay out of pocket on a claim. If you choose a higher deductible, your monthly premium may be lower, but if you file a claim, you will need to pay more out of pocket.

Things You Should Know When Shopping for Home Insurance Quotes

When looking for practical and affordable insurance quotes, you should know your property well. This means that you should obtain a claims history report from the seller detailing any previous damage to the home, such as flooding, fires, and other incidents. This report can let you know about any of the home’s frailties that could increase your premiums, or even make it difficult for you to get insurance. Lastly, when it comes to selecting home insurance coverages and receiving your quote, it is essential to be honest. Providing the proper information helps your insurance company provide more reliable protection and a more accurate quote. If you provide incorrect information, you could not only end up with an inaccurate quote, but the insurer may end up canceling your policy.

Contact Us today

There are just a few considerations to keep in mind when shopping for home insurance quotes in order to get the right policy for your situation. Trueway Insurance in Palm Springs provides affordable insurance for every budget. Call us today for a consultation!