In some states having auto insurance isn’t required. There are a number of places that will let you have alternatives to buying an insurance policy, which may sound like a good idea since it will save you from having to search to find the best auto or home insurance quotes out there. However, other people are raising their eyebrows over the issue and questioning whether or not this is actually helping or hurting you in the long wrong. Trueway Insurance in Lake Worth wants to make sure you have all of the information and details you need before hitting the road.

Understanding Auto Insurance Alternative and What They Mean For You

People spend an endless amount of time online searching for the best auto and home insurance quotes to make sure that they are getting the best deal out there, but what if you didn’t have to waste time anymore. Unlike homeowners insurance, most places require drivers to get car insurance. However, this is changing! There are now alternatives available to drivers, so they don’t have to buy an insurance policy.

The way these alternatives work is each state that decides to make these available to their residents come up with their own requirements. What this means, though, is the rules and requirements may change every time new legislation gets put into place. There are certain states throughout the U.S. where you don’t necessarily need car insurance, but you need to be able to prove that you have the financial means and resources to cover any costs that may be acquired because of an at-fault accident, however, if you’ve been arrested and found guilty of a DWI you may be required to have actual insurance. In Mississippi, there is minimum liability insurance that has been in effect since 2000. Drivers may be able to meet the requirements with just a cash or security deposit. Arizona has similar options available to their drivers where minimum insurance requirements are in place. If a driver doesn’t have insurance, they may also be able to prove financial responsibility with a $40,000 bond. If you reside in Virginia, you have the option of registering your car as an uninsured vehicle. When you choose to do this, there is an Uninsured Vehicle Fee of $500 that needs to be paid, and it is good for up to twelve months.

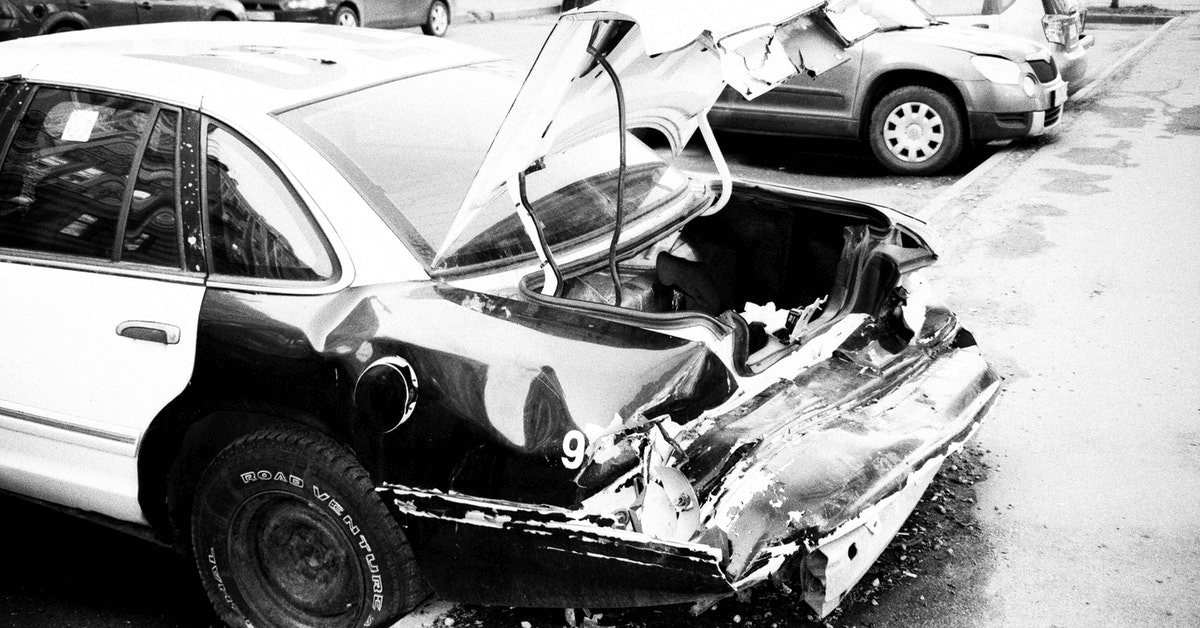

You may be wondering why liability insurance is such a big deal when it comes to covering drivers. The easiest way to think about insurance is to picture liability insurance as an umbrella that covers all expensive costs that can come with a car accident. Liability coverage will not only cover property, but it will also cover any personal injuries. A few years back, liability insurance covered almost $17,000 for bodily injuries and about $3,000 for property claims.

Contact Us For Home Insurance Quotes

Trueway is a leading auto insurance provider in the Lake Worth area. We are here to help our customers understand how to find cheap auto insurance as well as the measures they can take to ensure their cars are protected. If you’re tired of shopping around for home insurance quotes, call or visit us today for more information.