Are you the owner of a business that actively uses vehicles in its daily functions? Finding the right company for commercial auto insurance can be tough. Luckily with Trueway Insurance, we offer the best auto insurance in Lake Worth. If you find yourself a little discouraged when it comes to what the best auto policies are, our professionals are here to help.

Check Out These 5 Tricks for The Best Auto Insurance

- Cognizances

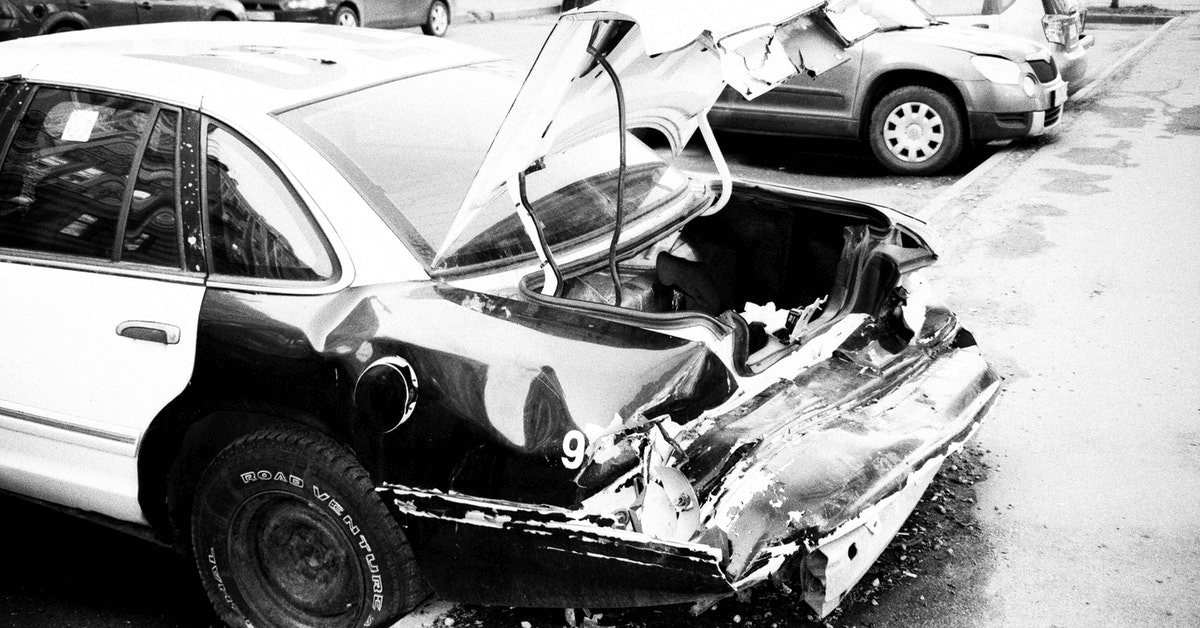

- You’ve got to be mindful of the different kinds of truck insurance. While there are numerous factors to consider when insuring your truck, commercial vehicle insurance can be broken down into 4 main types:

- Liability insurance – this is the mandatory insurance which pays for any damage you cause while utilizing your truck. Driving without this insurance is illegal and may cause heavy penalties.

- Physical damage coverage – not really a legal requirement, yet this insurance covers your truck against perils like fire, theft, and flood damage.

- Cargo – this insurance covers the contents you’re carrying. It isn’t really required however some shipping companies will require it.

- Bobtail insurance – also referred to as non-trucking liability, A term created applying to auto liability i nsurance for an owner/operator after a load has been delivered while your truck is not being used for trucking purposes.

- You’ve got to be mindful of the different kinds of truck insurance. While there are numerous factors to consider when insuring your truck, commercial vehicle insurance can be broken down into 4 main types:

- The Basics.

- The information you’ll need to acquire commercial truck insurance. Even just getting set up with truck insurance might be a tricky process, though it’ll be a little smoother when you furnish as much information as is feasible. Some insurance companies will give you a quote without having the following information, but they will need proof of this data before you can actually purchase coverage.

- Your current insurance coverage declarations page.

- Drivers license numbers and basic driving records of all drivers, including all tickets.

- VIN numbers of each vehicle, including a rundown of safety and security features on each truck.

- If there’s any information you simply can’t find, some companies will provide you with a quote based on your estimations. However, the quote will change when they inevitably determine the facts.

- The information you’ll need to acquire commercial truck insurance. Even just getting set up with truck insurance might be a tricky process, though it’ll be a little smoother when you furnish as much information as is feasible. Some insurance companies will give you a quote without having the following information, but they will need proof of this data before you can actually purchase coverage.

- The Factors.

- The key factors affecting commercial vehicle premiums. To a degree, you possibly can control some of the essential factors which govern your truck’s insurance costs. The key issues which come into play include:

- Driving record

- Garaging location

- Limit of liability insurance required.

- The key factors affecting commercial vehicle premiums. To a degree, you possibly can control some of the essential factors which govern your truck’s insurance costs. The key issues which come into play include:

- Methodology.

- Methods used to save money on commercial insurance. There are a few key do’s and don’ts for saving money on your insurance, but maybe the best recommendation is, to be honest regardless of how tempting it could be to overstate the value of your truck or forget to mention a speeding ticket. Some truckers even overstate the price of their vehicles hoping that they will get a good deal if anything happened to it. That is not how insurance works. Your insurer will discover just how much it would cost to obtain a comparable replacement. Should you say that your truck is worth more than it is, then you are more likely to over-pay for your coverage.

- ICC (Interstate Commerce Commission) authorities and MC (Motor Carrier) numbers.

- You will need to get an MC number from your ICC authority before you ship goods across state lines. In order to obtain one, your bodily injury and property damage insurance coverage will need to meet the prerequisites based on weight and class of your vehicle as well as the loads you’ll be carrying.

- For vehicles with a Gross Vehicle Weight rating of 10,001 pounds or higher:

- $750,000 for general, non hazardous commodities.

- $1,000,000 for hazardous freight except for class A and class B explosives.

- $5,000,000 for class A and class B explosives.

- Non-hazardous freight under 10,000 lbs requires a $300,000 minimum.

- For vehicles with a Gross Vehicle Weight rating of 10,001 pounds or higher:

- You will need to get an MC number from your ICC authority before you ship goods across state lines. In order to obtain one, your bodily injury and property damage insurance coverage will need to meet the prerequisites based on weight and class of your vehicle as well as the loads you’ll be carrying.

Call Us About Commercial Auto Insurance Today

Trueway Insurance is an insurance company located in Lake Worth. We offer the best auto insurance and commercial auto insurance quotes. This includes those looking for cheap car insurance. We are here to provide quality for our customers because we believe in the power that insurance can have in any person’s life. If you are interested in learning more about what we can do for you or you have further questions regarding notaries and how they play a part in the insurance process, contact us. We hope you find the information you need here but if not please give us a call at (561) 318-5540. Get an auto insurance quote today!