You can request and compare auto insurance quotes from competitors to find the best value for your car insurance needs, or you can simply contact Trueway Insurance in Palm Springs and have our experts do the legwork for you. We provide insurance for auto, homeowners, boat and motorcycle, commercial insurance, notary republic services, plates and registrations and so much more. Our bilingual agents are ready to help you lock in your competitive auto quote today to ensure you’re getting the best value for your insurance needs.

What Affects the Cost of Car Insurance?

Drivers often wonder what information affects their car insurance costs and most carriers won’t reveal their algorithm. Insurance companies factor in many things when estimating the cost of your coverage, including vehicle details, driver history, and their own company needs:

- Vehicle Factors

- Year— you can benefit from a new car discount depending on your carrier

- Make— luxury foreign cars cost more to insure due to repair and part costs

- Model— four door base models are the cheapest cars to buy and insure

- Vehicle Safety Features— insurance companies love air bags

- Car Alarm— alarm discounts can be applied if you have comprehensive coverage

- Coverage Purchased— more coverage costs more

- Number of vehicles you insure— benefit from multi-car discounts

- Driver Factors

- Age— preferred rates active at 25-yrs-old

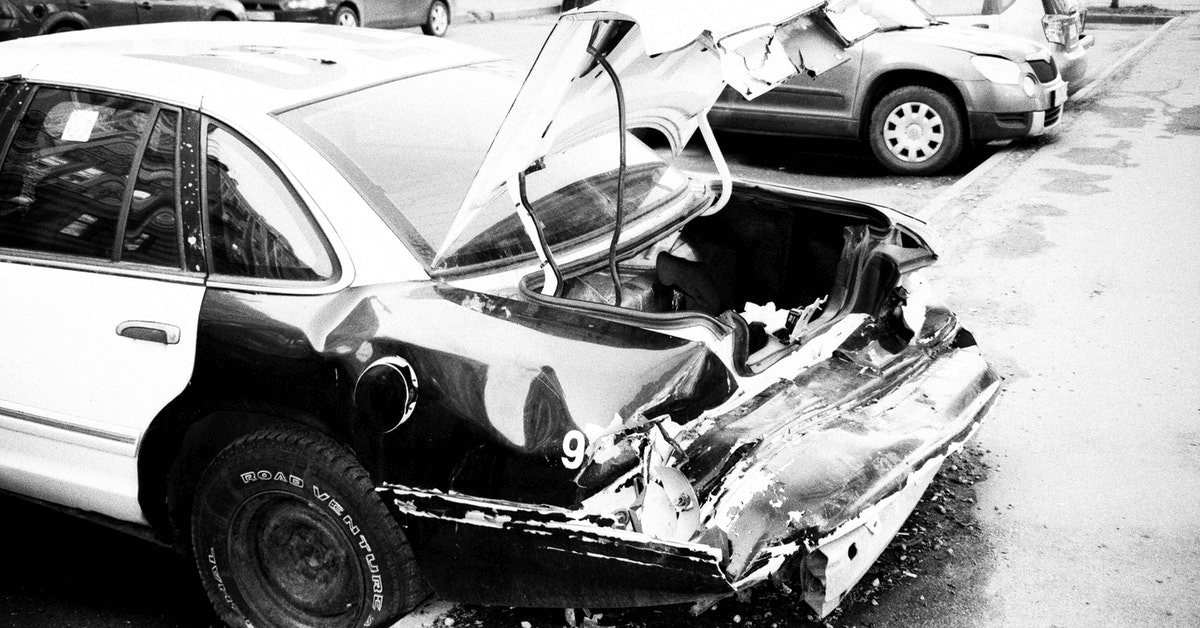

- Driving Record— tickets and accidents will raise your rates

- Number of Drivers for Your Vehicle— adding a young driver can raise rates

- Financial Stability— the better your credit score, the better your rate

- Primary Health Insurance Coverage— may not need as much medical coverage

- Home Ownership— bundle discounts and homeowners look more stable

- Where You Live— moving can change your rates

- Education / Good Student Discounts— responsibility equals savings

- Prior Limits of Liability— 100/300, 100k, and 300k are preferred liability limits

- Insurance company factors

- Profitability— weather, investments, and underwriting can affect this

- Payment Plans— different plans can affect overall costs

- Length of Time Insured— loyalty discount perks

- State Laws— you cannot go lower than your state’s minimum coverage limits

Drowning in Auto Insurance Quotes?

While a hefty money-saving discount may capture your initial attention, there may be hidden cost considerations beyond the premium price. The cheapest price doesn’t always equal the lowest cost. Switching insurance carriers could cost you loyalty and bundled discounts with your current provider. You could also end up losing earned accident forgiveness that prevents raised premiums after filing an insurance claim, or a lose any other special membership benefits based on the length of your relationship with your current insurance provider.

Contact Us Today!

You can save up to $100 a month with Trueway Insurance in Palm Springs. Provide us with a little information about yourself and we’ll find the car insurance that best fits your needs. We sell insurance anywhere in the state of Florida and our experienced agents know how to find competitive, quality auto insurance quotes so you don’t have to. Contact us today!